Saving for a car without taking out a loan might seem daunting, but it’s entirely achievable with careful planning and consistent saving habits. This guide will equip you with practical strategies to help you reach your car-buying goal debt-free. We’ll explore effective methods to budget effectively, identify areas to cut expenses, and maximize your savings potential. Learn how to build a robust savings plan, track your progress, and stay motivated throughout the journey towards owning a car cash.

Many people assume that buying a car necessitates a loan, but financing a vehicle often leads to high-interest payments and long-term debt. By following a disciplined approach to saving, you can avoid the burden of car loan payments and gain the significant financial advantages of buying a car in cash. This includes negotiating a lower purchase price, owning the car outright, and avoiding the often-hidden fees associated with car financing. Discover how to strategically manage your finances to achieve your financial freedom and realize the dream of owning a car without debt.

Decide on a Realistic Budget

Saving for a car without a loan requires a realistic budget. This involves honestly assessing your current financial situation and identifying areas where you can cut back on spending.

Start by tracking your income and expenses for a month or two. This will give you a clear picture of where your money is going. Categorize your expenses to see which areas consume the most funds. Look for areas where you can reduce spending, even small amounts can add up over time.

Determine how much you can realistically save each month. This amount should be consistent and attainable without significantly impacting your lifestyle. Be conservative in your estimate; it’s better to undershoot and exceed your savings goal than to overestimate and fall short.

Consider the total cost of car ownership beyond the purchase price. Factor in expenses like insurance, registration fees, taxes, maintenance, and fuel. Include these costs when determining your savings target to avoid unexpected financial burdens.

Once you have a clear understanding of your income, expenses, and savings potential, you can set a realistic savings goal and timeline. This will provide a roadmap for achieving your car-buying goal without debt.

Open a Dedicated Car Savings Account

Saving for a significant purchase like a car requires discipline and a clear strategy. Opening a dedicated savings account specifically for your car fund is a crucial first step. This account acts as a visual reminder of your goal and helps you track your progress effectively. The separation from your general savings prevents accidental spending and maintains the focus on your automotive objective.

Choosing the right account type is important. Consider a high-yield savings account to maximize your returns. These accounts typically offer higher interest rates than standard savings accounts, allowing your money to grow faster. However, always compare interest rates and fees across various financial institutions to find the best option for your needs. Careful consideration of interest rates and fees is essential for optimal savings growth.

Regular contributions are key to success. Establish a consistent savings plan and automate your transfers to ensure you contribute regularly. Even small, consistent deposits will add up over time. Setting up automatic transfers from your checking account to your car savings account eliminates the possibility of forgetting to contribute and streamlines the savings process. Consistency in contributions is critical to accumulating the required funds.

Beyond the account itself, it’s beneficial to establish a realistic savings goal and timeline. Knowing exactly how much you need to save and when you want to reach your goal provides crucial direction. This allows you to adjust your monthly contributions accordingly, ensuring you stay on track to achieve your financial objective without undue financial stress.

Automate Weekly or Monthly Contributions

Saving for a significant purchase like a car requires discipline and consistency. One of the most effective strategies is to automate your savings contributions. By setting up recurring transfers from your checking account to a dedicated savings account, you eliminate the need for manual effort and reduce the risk of forgetting to save.

Most banks and financial institutions offer the capability to schedule automatic transfers. You can specify the amount and frequency of the transfers, whether it’s weekly, bi-weekly, or monthly, depending on your budget and savings goals. This automated system ensures a consistent flow of funds into your car savings account, allowing your savings to grow steadily over time.

Consider setting up a separate savings account specifically for your car purchase. This keeps your funds earmarked for their intended purpose and prevents accidental spending. Many banks offer high-yield savings accounts, which can help your savings grow faster through interest accrual. The benefit of automation is further amplified when combined with a high-yield account.

The frequency of your contributions – weekly or monthly – depends on your personal preferences and financial capabilities. Weekly contributions might be preferable for those with a tighter budget, allowing for smaller, more manageable savings increments. Monthly contributions, on the other hand, might suit individuals who prefer larger, less frequent contributions.

Regardless of your chosen frequency, the key is consistency. By automating your contributions, you remove the decision fatigue associated with manually transferring funds each pay period. This allows you to consistently save without having to actively remember or plan each transfer. This automated approach is a crucial element of building a successful car savings plan.

Sell or Trade Old Items

One effective way to accumulate funds for a car purchase is to declutter your home and sell or trade items you no longer need or use. This can generate a surprising amount of cash quickly.

Consider selling items of high value such as electronics, jewelry, or collectibles through online marketplaces or local consignment shops. For items of lesser value, hosting a garage sale or utilizing online classifieds can be a convenient option.

Trading unwanted items for goods or services can also be beneficial. For example, you might be able to trade old sporting equipment for car repairs or exchange unused gift cards for cash.

Thoroughly assess the value of your possessions before setting prices. Research similar items sold online or in local stores to establish a fair market price. Be prepared to negotiate with potential buyers, but avoid selling items for significantly less than their worth.

Remember to account for fees associated with selling platforms or consignment shops. This will help ensure you accurately calculate your final profit. The more items you sell, the more money you will have towards your car savings.

Avoid Financing Traps

Saving for a car without a loan requires discipline and planning, but it offers significant long-term benefits. One of the most crucial aspects is avoiding the pitfalls of car financing. High-interest rates can quickly negate the financial advantages of buying a car outright.

Many dealerships aggressively push financing options, making them seem incredibly appealing. However, it’s crucial to understand the total cost of borrowing. This includes not only the principal loan amount but also the interest accumulated over the loan term. These interest charges can significantly inflate the final price of the vehicle.

Another trap to be aware of is the extended loan term. While seemingly more affordable with lower monthly payments, longer loan terms mean paying substantially more interest over the life of the loan. Opting for a shorter loan term, even if it means higher monthly payments, will ultimately save you a significant amount of money.

Pre-approval from banks or credit unions can provide a benchmark for comparing dealership financing offers. By securing pre-approval, you know your interest rate beforehand and can avoid being pressured into accepting a less favorable offer. Remember to always carefully read and understand the terms of any loan agreement before signing.

Finally, be wary of add-on products and services that dealerships often try to include. These can range from extended warranties to paint protection, adding unnecessary costs to your car purchase. Evaluate whether these extras are truly necessary and worth the added expense.

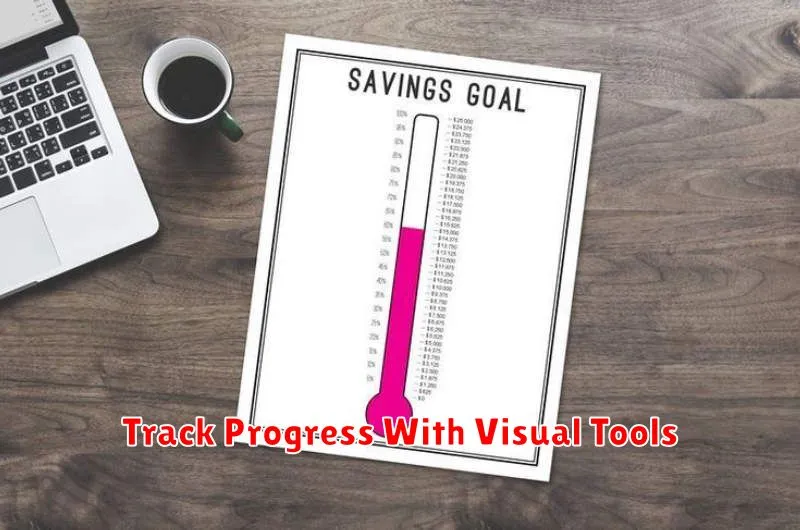

Track Progress With Visual Tools

Tracking your savings progress is crucial for maintaining motivation and ensuring you stay on track. Visual tools can significantly aid this process by providing a clear and engaging representation of your financial journey. Consider using a variety of methods to suit your preferences.

A simple yet effective approach is a progress bar. You can create one manually on a piece of paper or use a spreadsheet program to track your savings against your target. Seeing the bar gradually fill up provides a strong sense of accomplishment and visually reinforces your progress.

Alternatively, explore the use of savings charts. These can be line graphs showing your savings over time, bar charts comparing monthly contributions, or pie charts illustrating the proportion of your savings goal already achieved. These provide a more detailed overview of your saving habits and help identify any areas needing adjustment.

For a more interactive experience, consider utilizing mobile apps or online tools designed for budgeting and savings tracking. Many offer visually appealing dashboards and progress visualizations, often incorporating gamification elements to enhance engagement. These tools can automate some tracking aspects, freeing up your time and minimizing the risk of errors.

No matter the method you choose, the key is to find a visual representation that resonates with you and keeps you motivated. Regularly reviewing your chosen tool will not only help you stay focused but also provide a sense of satisfaction as you inch closer to your car-buying goal.