Are you tired of living paycheck to paycheck? Do you dream of achieving financial freedom but feel overwhelmed by the prospect of budgeting? This article will guide you through a simple yet effective method: weekly budgeting. Learning how to effectively manage your money on a weekly basis can significantly improve your financial health, allowing you to track your spending, identify areas for improvement, and ultimately achieve your financial goals. We’ll cover essential strategies for creating a realistic weekly budget, incorporating savings and debt reduction, and navigating unexpected expenses.

This comprehensive guide will empower you to take control of your finances. We’ll demystify the process of weekly budgeting, providing practical tips and actionable steps to help you build good financial habits. Whether you’re a student, young professional, or simply looking to enhance your personal finance management skills, this step-by-step approach will help you master weekly budgeting and pave the way for a more secure financial future. Prepare to transform your relationship with money and achieve lasting financial stability.

Why Weekly Budgets Work Better

Adopting a weekly budget offers several key advantages over traditional monthly budgeting. The most significant benefit lies in its enhanced control and visibility. By tracking your spending on a weekly basis, you gain a much clearer and more immediate understanding of your financial habits.

A weekly budget provides a more accurate reflection of your spending patterns. Monthly budgets can mask inconsistencies and overspending that occurs throughout the month. Weekly monitoring allows for early detection of problematic spending habits, enabling quicker adjustments before they negatively impact your overall financial health.

Furthermore, a weekly budgeting approach fosters a sense of greater accountability. The frequency of review promotes mindful spending, encouraging you to make conscious decisions rather than letting expenses spiral uncontrollably. This heightened awareness aids in achieving short-term financial goals more effectively.

The flexibility inherent in weekly budgeting also deserves mention. Life throws curveballs; unexpected expenses inevitably arise. A weekly budget allows for greater adaptability and smoother navigation of unforeseen costs, minimizing their disruptive impact on your overall financial plan. This adaptive nature makes weekly budgeting particularly valuable for those with fluctuating incomes or irregular expenses.

Finally, managing a weekly budget cultivates stronger financial discipline. The consistent monitoring and adjustments required enhance your financial awareness and decision-making capabilities. This continuous engagement ultimately empowers you to take greater control of your finances and move towards a more secure financial future.

Break Monthly Income into Weekly Portions

Budgeting on a weekly basis requires a clear understanding of your weekly income. To achieve this, you must accurately translate your monthly income into a weekly equivalent. This is a crucial first step to effective weekly budgeting.

The most straightforward method involves dividing your monthly net income (after taxes and deductions) by four. This provides a rough estimate of your weekly income. For example, if your monthly net income is $2,000, your estimated weekly income would be $500 ($2000 / 4 = $500).

However, this method assumes a consistent four-week month, which isn’t always the case. For greater accuracy, consider the actual number of weeks in a given month. A quick calculation involving the number of days in the month and dividing by 7 will give you a more precise weekly income figure. This method will account for variations in monthly length.

Regardless of the chosen method, it is vital to account for any inconsistencies in your monthly income. If you receive bonuses, commissions, or other irregular payments, incorporate these into your weekly budget calculation proportionally. Remember, consistency is key to successful weekly budgeting. Understanding your true weekly disposable income is paramount to creating a realistic and effective budget.

Once you have a clear figure for your weekly income, you can begin to allocate funds towards your various expenses, saving goals and any other financial obligations. This step-by-step approach ensures that you remain in control of your finances throughout the month.

Set Spending Limits Per Category

Creating a weekly budget requires careful consideration of your spending habits. To effectively manage your finances, it’s crucial to categorize your expenses and set realistic spending limits for each category. This approach allows for better financial control and prevents overspending in specific areas.

Start by listing all your typical weekly expenses. Common categories include groceries, transportation (gas, public transit, tolls), dining out, entertainment, and personal care. Consider adding categories specific to your lifestyle, such as subscriptions or pet expenses.

Next, allocate a specific dollar amount to each category based on your weekly income and spending patterns. Be realistic; don’t set limits too low to be restrictive or too high to be effective. Review your past spending to determine reasonable amounts for each category. Using budgeting apps or spreadsheets can greatly simplify this process.

Remember that flexibility is key. While sticking to your budget is important, unforeseen circumstances may arise. Building a small contingency fund within your weekly budget can help cover unexpected expenses without derailing your overall financial plan. Regularly review and adjust your spending limits as needed to ensure your budget aligns with your evolving needs.

Adjust Quickly Based on Real Spending

One of the greatest advantages of a weekly budget is its inherent flexibility. Unlike monthly budgets, which can feel rigid and inflexible, a weekly approach allows for quick adjustments based on your actual spending.

If you find you’ve overspent in one area, such as dining out, you can immediately compensate by reducing spending in another area, such as entertainment or shopping, during the remaining days of the week. This prevents overspending from snowballing into a larger problem by the end of the month.

Tracking your spending daily or at least several times a week is crucial for this adjustment process. By regularly reviewing your transactions, you gain real-time insight into where your money is going and can identify areas where you might need to make course corrections. This constant feedback loop allows for continuous improvement and better budgeting control.

This adaptive nature is particularly helpful when dealing with unexpected expenses. If an unforeseen bill arises, you can swiftly revise your budget to accommodate it without derailing your financial goals for the entire month. The weekly review helps you identify where to make necessary cuts and reallocate funds effectively.

Remember that budgeting is not about rigid adherence to a plan, but about smart financial management. The ability to adjust your weekly budget based on actual spending empowers you to take control of your finances and achieve your financial objectives.

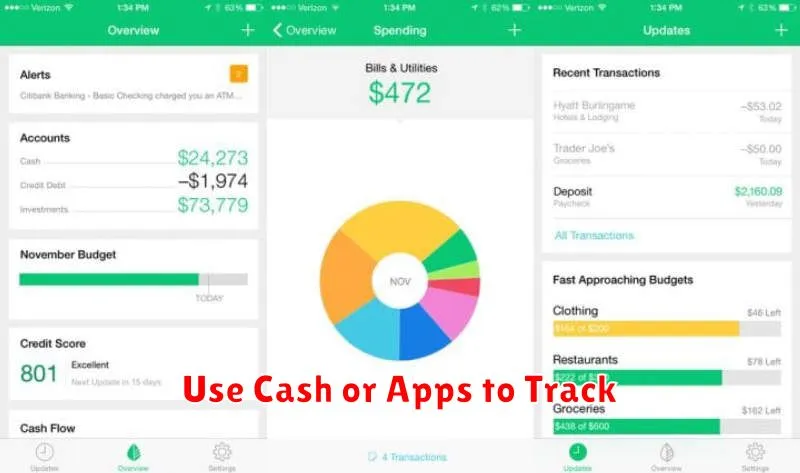

Use Cash or Apps to Track

Effective budgeting requires diligent tracking of your spending. Two primary methods offer distinct advantages: using cash and employing budgeting apps.

The cash method provides a tangible representation of your spending. By allocating a set amount of cash for each expense category (groceries, entertainment, etc.), you physically see your funds dwindle. This visceral experience can be incredibly effective in curbing impulsive purchases and promoting mindful spending. However, it can be less convenient than digital tracking for certain transactions.

Alternatively, numerous budgeting apps offer digital tracking solutions. These apps often integrate directly with your bank accounts and credit cards, automatically categorizing your expenses. Many provide features such as setting budgets, visualizing spending patterns, and generating reports. This automated approach simplifies tracking and offers valuable insights into your financial habits. The downside is the reliance on technology and the potential for inaccuracies if not properly set up and monitored.

The best approach depends on personal preference and financial habits. Some individuals find the physicality of cash highly effective, while others prefer the convenience and comprehensive data provided by budgeting apps. Experiment with both methods to determine which suits your needs and promotes the most responsible financial management.

Evaluate Each Week and Reset

At the end of each week, take some time to evaluate your spending against your budget. This crucial step allows you to identify areas where you may have overspent or underspent. Honest self-assessment is key here; don’t shy away from acknowledging any discrepancies.

This weekly review isn’t just about noting mistakes; it’s also an opportunity to celebrate successes. Did you stick to your grocery budget? Did you save more than anticipated? Recognizing these achievements reinforces positive financial habits and keeps you motivated.

Once you’ve completed your evaluation, it’s time for a reset. This involves transferring any remaining funds from your allocated categories to your savings or emergency fund. You might also adjust your budget for the upcoming week based on your learnings from the previous week. Perhaps you need to allocate more funds to groceries or less to entertainment.

The weekly reset is a powerful tool for maintaining budget discipline. It prevents small overspending from snowballing into larger problems and allows for continuous adaptation to your spending habits and unexpected expenses. By regularly evaluating and resetting, you transform budgeting from a rigid constraint into a dynamic and adaptable system that works for you.