Understanding your credit utilization ratio is crucial for maintaining a healthy credit score. This metric, representing the percentage of your available credit you’re currently using, significantly impacts your creditworthiness. A high credit utilization can negatively affect your credit report, potentially leading to higher interest rates on loans and credit cards. This article will delve into the intricacies of credit utilization, explaining its calculation, its impact on your financial health, and strategies for improving your credit score by managing your credit utilization ratio effectively.

We will explore the best practices for keeping your credit utilization low, discussing the advantages of maintaining a low ratio and the potential consequences of exceeding recommended thresholds. Learn how to monitor your credit cards and other credit accounts, and discover effective strategies for lowering your credit utilization and ultimately improving your overall financial standing. Understanding and managing your credit utilization is a key step towards achieving your financial goals and securing favorable credit terms in the future. This guide will provide you with the knowledge and tools necessary to take control of your credit and build a strong credit history.

What Is Credit Utilization Ratio?

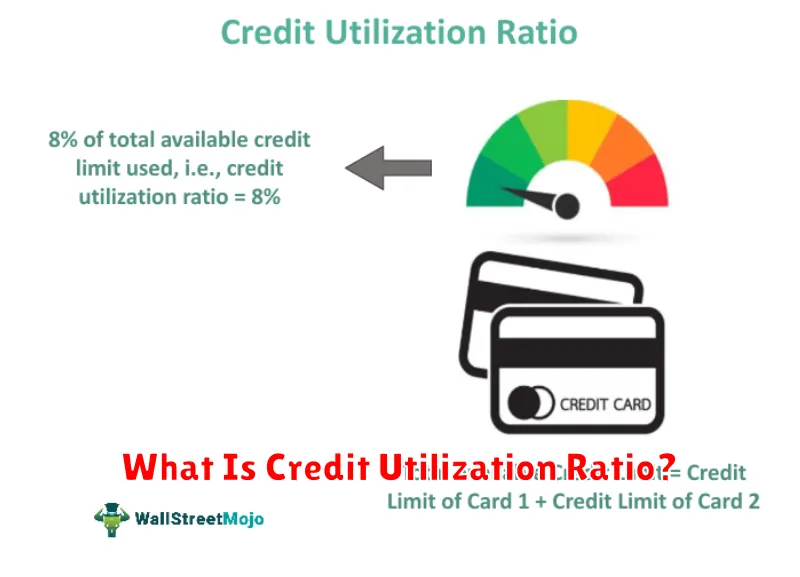

Your credit utilization ratio is a crucial factor in determining your creditworthiness. It’s simply the percentage of your available credit that you’re currently using. This is calculated by dividing your total credit card balances by your total available credit across all your credit cards.

For example, if you have a total credit limit of $10,000 across all your cards and you currently owe $3,000, your credit utilization ratio is 30% ($3,000 / $10,000 = 0.30 or 30%). This is a significant metric because it reflects your debt management habits to lenders.

Credit bureaus use this ratio in their credit scoring models. A lower credit utilization ratio generally results in a higher credit score, as it signals responsible spending and financial management. Conversely, a high credit utilization ratio can negatively impact your credit score, suggesting potential overreliance on credit.

It’s important to understand that the impact of your credit utilization ratio on your credit score is not linear. While keeping it low is beneficial, it’s not necessary to aim for zero. A generally recommended target is to keep your credit utilization ratio below 30%, although some experts suggest staying under 10% for optimal credit score results. Monitoring your credit utilization is a key aspect of maintaining a healthy credit profile.

The calculation itself is straightforward, but understanding its impact on your credit score and overall financial health is vital. Consistently managing your credit utilization ratio effectively contributes to establishing a strong credit history.

Why It Affects Credit Score

Your credit utilization ratio, or the percentage of your available credit you’re using, is a significant factor in your credit score. Credit bureaus view high utilization as a red flag, suggesting you may be struggling to manage your finances.

Lenders use credit utilization as an indicator of risk. A high ratio implies you’re relying heavily on credit, which can increase the likelihood of default. Conversely, a low utilization ratio demonstrates responsible credit management and reduces the perceived risk to lenders.

The impact of credit utilization on your score isn’t uniform; it’s generally considered that maintaining utilization below 30% is ideal. Exceeding this threshold can negatively affect your score, with the impact becoming more pronounced as utilization increases. For example, utilization above 70% can severely damage your credit.

Each of the major credit bureaus (Equifax, Experian, and TransUnion) weighs credit utilization differently in their scoring models. However, they all recognize its importance as a key factor in determining creditworthiness.

Furthermore, consistent high utilization over time can have a more damaging effect than a single month of high spending. Lenders prefer to see a pattern of responsible credit use, reflecting financial stability.

Keep It Below 30% Rule

Maintaining a low credit utilization ratio is crucial for a healthy credit score. The widely accepted guideline is to keep your credit utilization below 30%.

Credit utilization refers to the amount of credit you’re using compared to your total available credit. For example, if you have a total credit limit of $10,000 and you’re currently using $3,000, your credit utilization is 30%. Staying below this 30% threshold demonstrates responsible credit management to lenders.

Exceeding the 30% mark consistently can negatively impact your credit score. Lenders view high utilization as a sign of potential financial strain, increasing the perceived risk associated with lending to you. This can result in lower credit scores and potentially higher interest rates on future loans or credit cards.

While aiming for below 30% is ideal, striving for even lower utilization, such as 10% or less, is even better. This significantly reduces the risk factors perceived by lenders and contributes positively to your creditworthiness.

Regularly monitoring your credit reports and paying down your balances promptly are effective ways to maintain a healthy credit utilization ratio and safeguard your credit score.

How to Lower It Quickly

Lowering your credit utilization ratio quickly requires a multifaceted approach. The most immediate impact comes from paying down your outstanding balances. Prioritize credit cards with the highest balances and interest rates first.

Consider making multiple payments throughout the month. Even small, additional payments can significantly reduce your utilization ratio before your next statement closes. This is particularly helpful if you have upcoming large purchases that may temporarily increase your utilization.

If you’re struggling to make large payments immediately, explore options like a balance transfer to a credit card with a lower interest rate and a 0% introductory period. This allows you to pay down the debt without accruing additional interest, freeing up more of your budget for principal payments and reducing your utilization rate sooner. Remember to factor in any balance transfer fees when considering this option.

Another effective strategy is to increase your credit limits. This is only advisable if you can manage your spending responsibly and avoid accumulating new debt. Contacting your credit card issuer and requesting a credit limit increase can lower your utilization ratio, provided that your outstanding debt remains unchanged. Be aware that this approach doesn’t address the underlying debt problem and should be used strategically.

Finally, consistent and responsible credit card management is paramount. Avoid opening new accounts unless absolutely necessary, and always strive to keep your spending below your available credit. Maintaining a low credit utilization ratio is a long-term strategy that positively impacts your credit score over time.

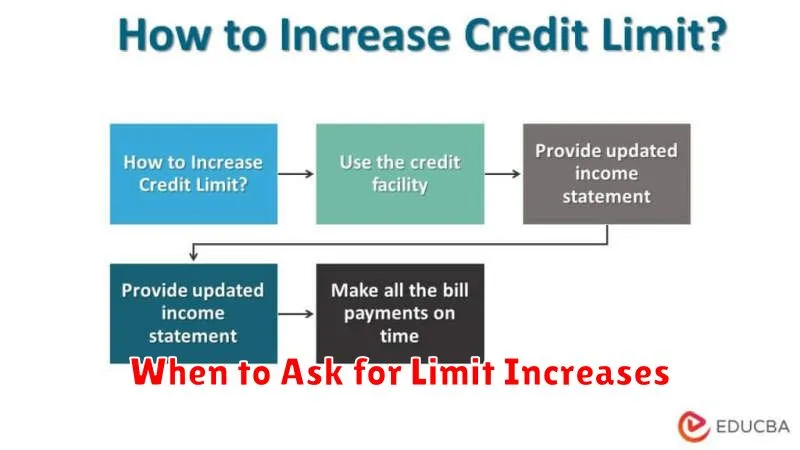

When to Ask for Limit Increases

Requesting a credit limit increase is a strategic move that can positively impact your credit score and financial flexibility. However, timing is crucial. Don’t rush into it; consider your financial situation carefully before applying.

One optimal time to consider a limit increase is when you’ve demonstrated responsible credit management over an extended period. This means consistently paying your bills on time, maintaining a low credit utilization ratio (ideally below 30%), and having a positive credit history. A strong track record shows lenders you’re a low-risk borrower.

Another favorable situation is when you experience a significant increase in your income. A higher income demonstrates improved financial stability, making you a more attractive candidate for a credit limit increase. This provides lenders with reassurance that you can comfortably manage a higher credit limit.

Conversely, avoid requesting a limit increase when you are facing financial hardship or struggling to manage your existing debt. Applying during times of financial stress could negatively impact your credit score and potentially be denied. Focus on improving your financial health before seeking a higher credit limit.

Finally, carefully weigh the potential benefits against the risks. While a higher limit can improve your credit utilization ratio, it can also tempt you to overspend. Ensure you have the discipline to manage increased credit responsibly.

Tools to Monitor It Daily

Effectively managing your credit requires consistent monitoring. Fortunately, several tools are available to help you track your credit utilization daily.

Credit monitoring services, such as those offered by Experian, Equifax, and TransUnion, provide detailed reports on your credit score and utilization. Many offer daily updates, allowing you to see any changes immediately. These services often include features beyond basic credit score tracking, such as alerts for suspicious activity and identity theft protection.

Your credit card statements are another valuable resource. While not providing a daily snapshot, reviewing your statements regularly allows you to track spending and ensure your utilization remains within a healthy range. Pay close attention to your credit limit and available credit to calculate your utilization percentage accurately.

Many banking and financial apps now include credit score tracking features, often integrated directly into your account dashboard. These apps provide convenient access to your credit information and may also offer personalized financial management tools.

Utilizing a personal finance management software or spreadsheet allows for meticulous tracking of your spending and credit card balances. By inputting your transactions regularly, you gain a clear picture of your credit utilization and can proactively adjust your spending habits to maintain healthy levels.

The best tool for you depends on your individual needs and preferences. Consider the features offered, the level of detail provided, and the cost associated with each option when making your choice. Proactive monitoring is key to maintaining a healthy credit score and minimizing the risk of negative impacts from high credit utilization.