Saving for a goal in just six months can feel daunting, but with a structured plan and unwavering commitment, it’s entirely achievable. This guide provides a practical, step-by-step approach to help you effectively save money for your short-term objective, whether it’s a down payment on a car, a much-needed home renovation, or that dream vacation you’ve been yearning for. We’ll explore effective budgeting strategies, smart saving techniques, and ways to identify and eliminate unnecessary expenses, ensuring you reach your financial goal within your six-month timeframe.

Our comprehensive guide will equip you with the tools to maximize your savings. Learn how to create a realistic budget that aligns with your income and expenditures, discover effective methods for tracking your spending, and uncover hidden opportunities to increase your savings. We’ll delve into the importance of setting realistic goals, establishing a consistent saving schedule, and staying motivated throughout the process. By the end, you’ll have a clear understanding of how to effectively save for your target amount in only six months.

Choose a Clear, Realistic Goal

Saving for a goal within six months requires a well-defined objective. Avoid vague aspirations; instead, choose a specific, measurable, achievable, relevant, and time-bound (SMART) goal. For example, instead of aiming to “save more money,” set a goal like “save $1,000 for a down payment on a used car.” This clarity provides the necessary focus for your savings plan.

Realism is crucial. Assess your current financial situation honestly. Consider your income, expenses, and existing debts. A goal that is too ambitious might lead to frustration and derail your efforts. If your income is limited, setting a smaller, more achievable goal will be more effective in the long run and encourage you to continue saving. Adjusting your expectations can prevent burnout.

Consider breaking down a large goal into smaller, manageable milestones. Instead of focusing solely on the final $1,000, break it down into monthly savings targets of $166.67. Achieving these smaller milestones provides a sense of accomplishment and keeps you motivated throughout the process. This approach also allows for flexibility in case of unforeseen circumstances.

Finally, ensure your goal aligns with your overall financial priorities. Saving for a vacation might be less urgent than saving for an emergency fund or paying down high-interest debt. Prioritize your goals to ensure you’re allocating your resources effectively. A clear understanding of your financial priorities helps you make informed decisions about your savings strategy and avoid potential financial pitfalls.

Break It Into Weekly Targets

Saving for a goal in six months requires a structured approach. Instead of focusing solely on the large, potentially overwhelming, final sum, break down your savings target into smaller, more manageable weekly targets. This strategy fosters a sense of consistent progress and prevents feelings of discouragement.

To determine your weekly savings goal, divide your total savings target by the number of weeks in six months (approximately 26 weeks). This calculation provides a clear weekly amount to save, making the overall objective feel less daunting.

For example, if your six-month savings goal is $1560, your weekly target would be $60 ($1560 / 26 weeks = $60/week). This consistent weekly contribution simplifies the process and facilitates better tracking of your progress. Remember to adjust this calculation based on your specific savings goal and the actual number of weeks in your six-month timeframe.

Tracking your weekly progress is crucial. Consider using a budgeting app, a spreadsheet, or even a simple notebook to monitor your savings. Regularly reviewing your progress helps maintain motivation and identify areas where adjustments might be needed. This proactive approach ensures you stay on track toward achieving your six-month savings goal.

Open a Separate Account for Focus

Saving for a specific goal within a tight timeframe like six months requires discipline and focus. Opening a separate savings account dedicated solely to your goal is a crucial step in achieving this.

This dedicated account acts as a powerful visual reminder of your objective. Seeing the balance grow reinforces your commitment and provides tangible evidence of your progress. More importantly, it separates your goal savings from your everyday spending, preventing accidental depletion.

Consider the psychological impact: commingling funds can make it tempting to dip into your savings for non-essential purchases. A separate account creates a psychological barrier, making it harder to justify unauthorized withdrawals and fostering a stronger sense of financial responsibility.

The convenience of having all your goal-related funds in one place simplifies tracking your progress and budgeting. You can easily monitor your savings and make informed decisions about your spending habits without the confusion of sifting through multiple accounts.

Ultimately, opening a separate account for your six-month goal is an effective strategy to boost motivation, improve financial clarity, and significantly increase your chances of successfully reaching your target within the desired timeframe.

Track and Adjust as You Go

Saving for a goal in six months requires consistent effort and monitoring. It’s unlikely your initial plan will perfectly align with reality. Unexpected expenses, changes in income, or simply a lack of motivation can throw off your trajectory.

Therefore, regular tracking of your progress is crucial. Use a budgeting app, spreadsheet, or even a simple notebook to record your savings each week or month. Compare your actual savings to your projected savings based on your initial plan. This allows you to identify any discrepancies early on.

Flexibility is key. If you fall short of your target, don’t get discouraged. Analyze the reasons for the shortfall. Did you overspend in a particular area? Did an unexpected expense arise? Once you understand the cause, you can make adjustments to your plan. This might involve cutting back on non-essential expenses, finding additional income streams, or re-evaluating your savings goal to make it more realistic.

Conversely, if you’re consistently exceeding your savings goal, you can either increase your savings target or allocate the extra funds towards other financial goals or even treat yourself to a small reward. The important thing is to maintain accountability and adjust your strategy as needed to stay on track towards your six-month objective.

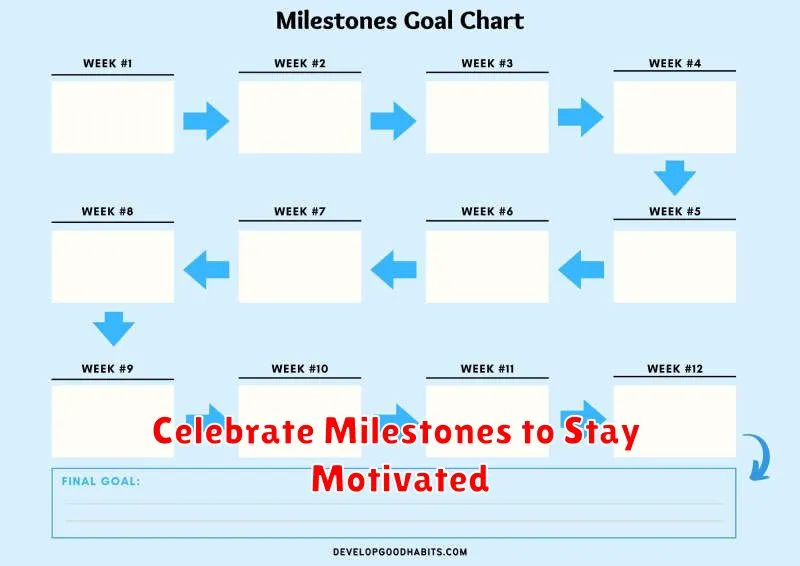

Celebrate Milestones to Stay Motivated

Saving for a goal in just six months requires dedication and discipline. It’s a challenging timeframe, and maintaining motivation throughout the process can be difficult. One highly effective strategy is to celebrate your milestones along the way.

Instead of focusing solely on the final destination, break your savings goal into smaller, more manageable chunks. For example, if you’re saving $1800, consider celebrating when you reach $300, $600, $900, and $1200. These smaller victories provide a sense of accomplishment and keep you moving forward.

The type of celebration doesn’t need to be extravagant. A small reward, like a nice dinner, a new book, or a movie night, can be very effective in boosting morale. The key is to acknowledge your progress and reinforce the positive behavior of saving.

This approach helps to prevent feelings of discouragement. When you see your progress visualized through these smaller goals and accompanying rewards, it serves as a powerful motivator to keep you on track and committed to achieving your larger financial objective.

Remember, the goal is to create a positive feedback loop. Consistent saving leads to milestone achievement, which in turn leads to celebration and renewed motivation to continue saving. This cyclical process is crucial for success in short-term savings plans.

Avoid Spending What You’ve Saved

One of the biggest hurdles to achieving your six-month savings goal is the temptation to spend the money you’ve already accumulated. It’s crucial to maintain a strong sense of discipline and self-control throughout the entire process.

Consider setting up a separate savings account specifically for your goal. This creates a visual and mental barrier, making it harder to access the funds impulsively. Treat this account as if it were completely inaccessible, even for emergencies. Having a dedicated account fosters a sense of accountability and helps you visualize your progress.

Avoid the temptation to reward yourself with purchases from your savings. While celebrating milestones is important, it’s best to set aside a small, separate fund specifically for such celebrations. This prevents you from depleting your primary savings and derailing your progress toward your financial goal.

Regularly review your budget and identify areas where you can further reduce expenses. This proactive approach helps ensure that you maintain a consistent savings rate and don’t deviate from your plan. Even small adjustments can make a significant difference over time. The key is consistency and commitment.

Remember, the purpose of saving is to achieve a specific financial objective within a defined timeframe. Keeping your eye on that goal and the benefits it will bring will help you stay focused and resist the urge to spend your hard-earned savings.