Building credit is crucial for achieving significant financial milestones, such as securing a mortgage, auto loan, or even renting an apartment. However, many individuals believe that obtaining a credit card is the only pathway to establishing a positive credit history. This is a misconception. This article will explore practical and effective strategies on how to build credit without a credit card, empowering you to improve your financial standing and unlock future opportunities.

Discover alternative methods to cultivate a robust credit score, even without relying on traditional credit cards. We’ll delve into various options including becoming an authorized user on someone else’s account, securing a secured credit card, utilizing credit-builder loans, and consistently paying your bills on time. Learn how these strategies contribute to a healthier credit report and help you achieve your financial goals. Let’s embark on this journey to improve your credit without the need for a credit card.

Why Alternatives Are Important

Building credit is crucial for many aspects of adult life, from securing loans to renting an apartment. However, the traditional route of using credit cards can be risky for individuals prone to overspending or those concerned about accumulating debt.

Alternatives to credit cards offer a safer and often more controlled path to establishing a positive credit history. They allow individuals to demonstrate responsible financial behavior without the temptation of readily available credit. This controlled approach minimizes the risk of financial hardship associated with high-interest debt and late payments.

Furthermore, some individuals may not qualify for a credit card due to a lack of credit history or other factors. In these situations, alternative credit-building methods provide a valuable opportunity to start building credit from scratch. These methods offer a crucial entry point into the financial system, paving the way for future financial opportunities.

Finally, exploring various alternatives empowers individuals to take a more proactive and informed approach to credit building. By understanding the range of options available, individuals can tailor their strategy to their specific financial circumstances and goals, ensuring a more sustainable and successful path towards establishing a strong credit score.

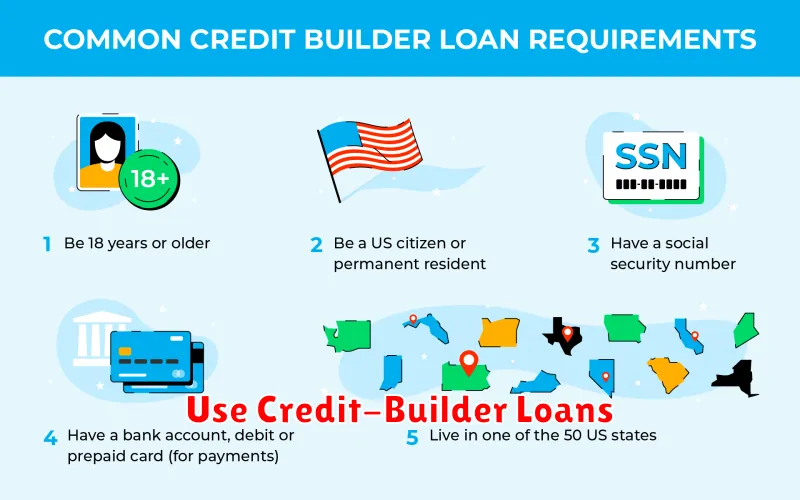

Use Credit-Builder Loans

A credit-builder loan is a secured loan specifically designed to help individuals with limited or no credit history establish a positive credit profile. These loans typically involve a small loan amount, often between $300 and $1,000, that’s deposited into a savings account. The loan’s repayment is reported to the major credit bureaus (Equifax, Experian, and TransUnion), allowing you to build credit as you consistently make payments on time.

Key Advantages of credit-builder loans include the relative ease of obtaining approval, even with poor or no credit history. Because the loan is secured, the lender has less risk. Furthermore, you’ll benefit from the discipline of regular payments, which directly contributes to a higher credit score. The funds are typically held in a savings account until the loan is repaid, offering a practical savings plan alongside credit building.

Important Considerations: While credit-builder loans can be an excellent option, it’s essential to understand the terms and conditions, including interest rates and fees. Compare offers from different lenders to find the most favorable terms. Always ensure you can comfortably afford the monthly payments to avoid negatively impacting your financial situation. A missed payment can hurt your credit score, negating the positive impact of the loan itself.

In short, a credit-builder loan offers a structured and relatively low-risk way to establish a strong credit history. By diligently making payments on time, you can steadily improve your creditworthiness, opening doors to more favorable financial opportunities in the future.

Report Rent and Utility Payments

Building credit without a credit card requires demonstrating responsible financial behavior. One effective method is reporting your rent and utility payments to credit bureaus. Many landlords and utility companies now offer this service, often through third-party reporting agencies.

The process typically involves providing your account information and authorizing the reporting of your payment history. This information is then submitted to major credit bureaus like Equifax, Experian, and TransUnion, allowing them to incorporate your consistent, on-time payments into your credit report.

Consistent on-time payments are crucial for building a positive credit history. Even small, regular payments like rent and utilities can significantly impact your credit score over time. The more positive payment history you accumulate, the stronger your credit profile will become.

Be sure to confirm with your landlord and utility providers whether they offer rent and utility reporting services. If they do not, you might consider exploring alternative options like specialized credit reporting services designed to report these types of payments. Thoroughly research any such service before using it to ensure its legitimacy and avoid scams.

Remember that reporting your rent and utility payments is only one component of credit building. Combining this with other strategies, such as paying off existing debts and maintaining low credit utilization, will significantly enhance your overall creditworthiness.

Become an Authorized User

One effective strategy to build credit without personally obtaining a credit card is to become an authorized user on someone else’s account. This approach leverages the established credit history of the primary account holder to positively impact your own credit report.

Authorized user status grants you access to the credit card account, enabling you to use the card and build your credit history. However, it’s crucial to understand that you are not liable for the debts incurred unless you co-signed for the account. The primary cardholder retains full responsibility for payments.

To become an authorized user, you will typically need the permission of the primary account holder. They will need to contact their credit card issuer and request to add you to their account. The issuer may perform a credit check on you, though this isn’t always the case.

Benefits of becoming an authorized user include the potential to establish positive payment history, increase your available credit, and diversify your credit profile. This can be especially helpful for individuals with limited or no credit history. However, it’s important to note that any negative activity on the primary account, such as late payments, could negatively impact your credit score.

Careful consideration is required before becoming an authorized user. Ensure you have a trustworthy relationship with the primary account holder and a clear understanding of the terms and conditions. Open communication about responsible usage and timely payments is essential to maintain a positive credit history.

Apply for a Secured Loan with Caution

Secured loans can be a valuable tool for building credit, especially for individuals with limited or no credit history. Unlike unsecured loans, secured loans require collateral, which reduces the risk for lenders and often makes approval easier. This collateral could be a savings account, a certificate of deposit, or other assets.

However, it’s crucial to approach secured loans with caution. The interest rates might be higher than unsecured loans, and missing payments can have serious consequences. Defaulting on a secured loan can result in the lender seizing your collateral. Therefore, it’s imperative to only borrow an amount you can comfortably repay.

Before applying for a secured loan, carefully compare interest rates and terms from multiple lenders. Understand the fees associated with the loan, including origination fees and any prepayment penalties. Thoroughly review the loan agreement before signing to ensure you understand all the terms and conditions.

Responsible repayment is critical. Always make your payments on time and in full to avoid late fees and negative impacts on your credit score. Consistent, on-time payments are essential for demonstrating creditworthiness and building a positive credit history.

Consider a secured loan only if you have a clear understanding of your financial situation and a realistic plan for repayment. Failing to meet your repayment obligations can negatively impact your credit score and potentially lead to the loss of your collateral.

Monitor Credit Score Growth

Building credit without a credit card requires consistent effort and careful tracking. One of the most crucial aspects of this process is monitoring your credit score growth. Regularly checking your score allows you to observe the effectiveness of your strategies and make necessary adjustments.

Several services provide access to your credit score and report. You can obtain a free credit report annually from each of the three major credit bureaus: Equifax, Experian, and TransUnion. These reports detail your credit history, including payment history, outstanding debts, and inquiries. While the report doesn’t include your exact score, it provides the data used to calculate it.

To get your credit score, you may need to subscribe to a credit monitoring service. These services often offer additional features like alerts for significant changes in your credit profile and personalized tips for credit improvement. Consider the cost versus the benefits when choosing a service.

Consistent monitoring is key. By tracking your score over time, you can identify trends and patterns. A steady increase indicates that your efforts are paying off. If you see little or no progress, review your strategies and identify areas for improvement. This proactive approach is vital for building a strong credit history without relying on a credit card.

Remember that building credit takes time. Don’t get discouraged if you don’t see immediate results. Consistent, responsible financial behavior, combined with regular monitoring, will eventually lead to a positive impact on your credit score.