Are you struggling to pay off debt? Many people find themselves trapped in a cycle of debt, often due to common mistakes that can be easily avoided. This article will explore the top mistakes individuals make when attempting to eliminate debt, providing actionable strategies to help you break free from financial burdens and achieve financial freedom. Understanding these pitfalls is crucial for creating a successful debt repayment plan and achieving your long-term financial goals. We’ll examine everything from high-interest debt management to the importance of budgeting and avoiding further debt accumulation.

From ignoring high-interest rates to neglecting proper budgeting and failing to track your progress, numerous factors can hinder your debt payoff journey. This guide is designed to empower you with the knowledge and tools needed to navigate the complexities of debt management effectively. We’ll delve into specific strategies for tackling various types of debt, including credit card debt, student loans, and personal loans, providing a comprehensive approach to debt consolidation and debt reduction. Prepare to learn how to avoid costly mistakes and pave your way towards a debt-free future.

Ignoring Interest Rates

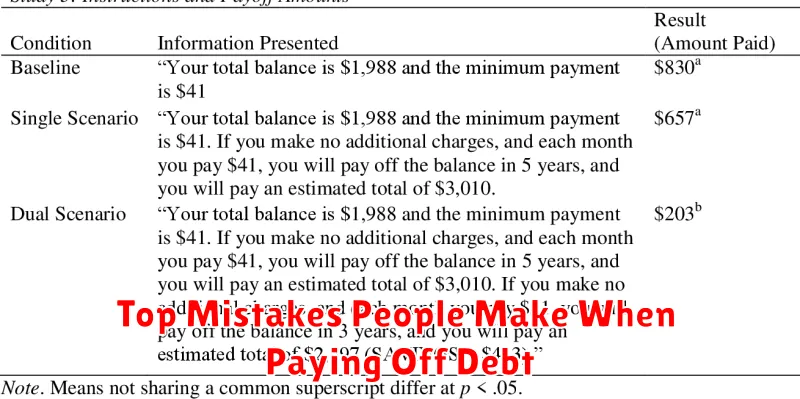

One of the most significant mistakes people make when tackling debt is ignoring interest rates. Understanding the interest rate on each debt is crucial for effective repayment. High interest rates can quickly compound your debt, making it significantly more expensive to pay off over time.

Failing to prioritize high-interest debts leads to paying more in interest overall. Prioritizing high-interest debt, such as credit card debt, allows you to save money on interest charges in the long run. This strategy effectively reduces the overall cost of your debt and accelerates your repayment journey.

Many people make the mistake of focusing solely on the minimum payment or paying off the smallest debt first. While these strategies might seem logical, they often overlook the crucial impact of interest accumulation. By understanding and addressing high-interest debts first, you can substantially decrease the total amount you pay back.

Furthermore, neglecting to compare interest rates across different debt types can cost you valuable resources. Understanding your interest rates empowers you to make informed decisions about your repayment strategy. This knowledge helps you determine the most effective approach to eliminate your debt as efficiently as possible.

In short, ignoring interest rates prevents a clear view of the true cost of your debt. A proactive approach involves understanding the interest rate on every debt and making calculated decisions to minimize its impact. This is a critical element in effectively managing and eliminating debt.

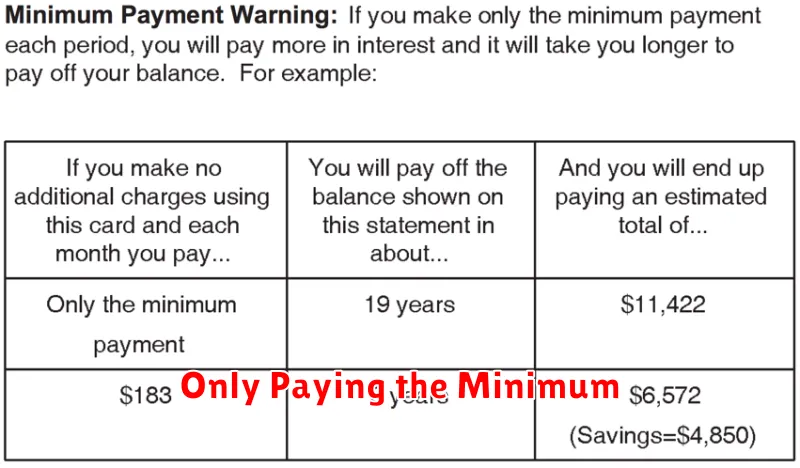

Only Paying the Minimum

One of the most significant mistakes people make when attempting to pay off debt is only paying the minimum payment required each month. While this might seem like a manageable approach, it significantly prolongs the repayment process and results in paying considerably more in interest over time.

The minimum payment usually only covers a small portion of your total balance, with the majority going toward interest charges. This means you’re essentially paying interest on your interest, creating a vicious cycle that makes it incredibly difficult to make meaningful progress toward becoming debt-free. The longer it takes to repay, the more interest you accumulate, potentially doubling or even tripling the original amount owed.

To illustrate, consider a credit card with a high interest rate. Even diligent minimum payments will only barely reduce the principal balance, while the accumulated interest continues to grow. This leads to a much longer repayment timeline and significantly higher overall costs. Therefore, prioritizing higher payments than the minimum is crucial for effective debt reduction.

To effectively manage and pay down debt, creating a budget and prioritizing extra payments towards high-interest debts is a better strategy. This allows for faster debt repayment, minimizing the total interest paid and achieving financial freedom sooner.

Taking New Debt While Repaying Old

One of the most common, and damaging, mistakes people make when tackling debt is taking on new debt while still paying off existing obligations. This creates a vicious cycle that can significantly hinder progress and even worsen your overall financial situation.

When you’re juggling multiple debts, it becomes harder to track payments and allocate funds effectively. This can lead to missed payments, late fees, and a lower credit score. The interest accumulating on both old and new debts quickly compounds, resulting in a much larger total debt burden than initially anticipated.

Even seemingly small new debts, such as using a credit card for everyday purchases or taking out a payday loan, can significantly derail your debt repayment plan. These seemingly minor expenses add up, and the interest charged can quickly negate any progress made on your existing debts. It’s crucial to prioritize paying off existing debts before incurring any new ones.

Before considering any new debt, carefully assess your current financial situation and create a realistic budget. Determine whether you can comfortably manage the repayments of existing and potential new debts. Avoid impulsive spending and focus on creating a clear plan to eliminate your existing debt before seeking out additional financial obligations.

Not Tracking Progress Monthly

One of the biggest mistakes people make when attempting to pay off debt is failing to track their progress on a monthly basis. Without regular monitoring, it’s easy to lose sight of your goals and become discouraged.

Consistent tracking allows you to visualize your progress and celebrate small victories along the way. Seeing the reduction in your debt balances each month provides motivation and a sense of accomplishment, encouraging you to stay committed to your repayment plan.

Moreover, monthly tracking helps you identify areas needing adjustment. If your progress is slower than expected, you can analyze your spending habits, explore additional income sources, or re-evaluate your debt repayment strategy. This proactive approach allows for course correction and prevents you from falling behind schedule.

Tools like spreadsheets, budgeting apps, or even a simple notebook can be invaluable in tracking your debt payments and overall financial progress. The key is to find a system that works for you and stick to it consistently. Without this regular monitoring, you risk losing sight of your financial goals and potentially abandoning your debt repayment plan entirely.

Stopping Contributions to Emergency Funds

One of the most detrimental mistakes individuals make while aggressively paying down debt is halting contributions to their emergency funds. While focusing on debt reduction is crucial, neglecting a financial safety net can lead to unforeseen complications.

An unexpected event, such as a job loss, medical emergency, or car repair, can easily derail even the most meticulously planned debt repayment strategy. If you find yourself suddenly facing a significant unexpected expense without sufficient savings, you might be forced to use high-interest credit cards or borrow money, potentially increasing your overall debt and hindering your progress toward financial freedom.

Maintaining an emergency fund acts as a buffer against these unforeseen circumstances. It allows you to address unexpected expenses without resorting to additional debt, protecting your hard-won progress in paying down existing obligations. The recommended amount for an emergency fund is typically three to six months’ worth of living expenses, but even a smaller amount is better than nothing.

Therefore, while diligently paying down debt is essential, it’s equally important to maintain a healthy emergency fund. Prioritizing debt repayment shouldn’t come at the cost of financial security. A balanced approach, encompassing both debt reduction and emergency savings, creates a more sustainable and less stressful path to financial stability.

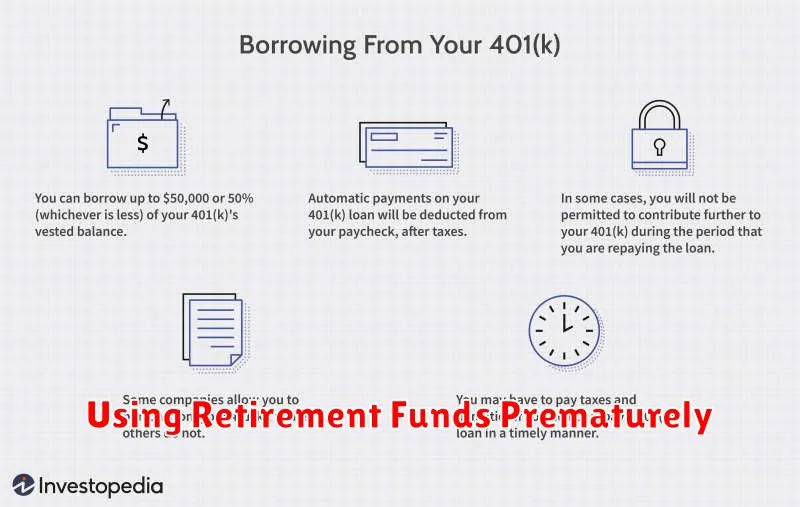

Using Retirement Funds Prematurely

One of the most significant financial mistakes individuals make when tackling debt is prematurely accessing their retirement funds. While the allure of quickly eliminating debt is understandable, raiding retirement savings often carries severe long-term consequences.

Early withdrawals from retirement accounts, such as 401(k)s or IRAs, typically incur significant penalties and taxes. These fees can substantially reduce the amount ultimately available to pay down debt, potentially negating any perceived benefit. Furthermore, the lost potential for compound interest over the years represents a considerable opportunity cost, severely impacting future retirement security.

Beyond the immediate financial penalties, depleting retirement savings prematurely can leave individuals vulnerable to financial insecurity in their later years. It may necessitate reliance on Social Security or other government assistance programs, or force a continued work life well beyond the desired retirement age. The long-term implications of this decision can significantly outweigh the short-term relief provided by accelerated debt repayment.

Before considering using retirement funds for debt repayment, it is crucial to explore alternative strategies. Consult with a financial advisor to evaluate various options, such as debt consolidation, budgeting adjustments, or negotiating with creditors. They can help develop a personalized plan that addresses debt effectively without jeopardizing your long-term financial well-being.