Are you trapped in a seemingly endless cycle of payday loans? The high-interest rates and short repayment periods can quickly become overwhelming, leaving you feeling financially suffocated. Many find themselves borrowing again and again just to cover the previous loan, creating a vicious debt spiral. This article provides a comprehensive guide on how to break free from the grip of payday loan debt and regain control of your finances. We’ll explore practical strategies to manage your cash flow, negotiate with lenders, and develop long-term financial stability. Learn how to effectively manage debt and avoid the pitfalls of high-interest loans.

Breaking free from a payday loan cycle requires a proactive and multi-faceted approach. It’s crucial to understand the mechanics of these loans and how they contribute to financial instability. We will delve into budgeting techniques to help you track your spending and identify areas where you can cut back. Furthermore, we’ll examine various debt consolidation options and explore resources available to help you navigate the complexities of debt management. Discover how to build a healthier financial future and permanently escape the burden of short-term loans. This is your guide to achieving financial freedom and escaping the payday loan trap.

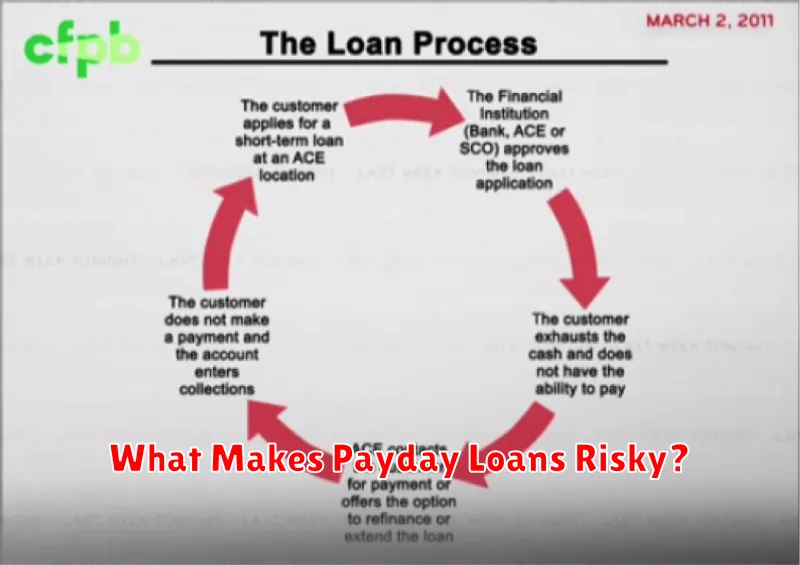

What Makes Payday Loans Risky?

Payday loans, while seemingly offering a quick solution to financial emergencies, are fraught with risks that can trap borrowers in a cycle of debt. The high interest rates are a primary concern. These loans typically charge extremely high Annual Percentage Rates (APRs), far exceeding those of traditional loans. This means that even a small loan can quickly accumulate significant interest, making repayment increasingly difficult.

Another significant risk is the short repayment period. Payday loans are designed to be repaid on your next payday, often within two weeks. This short timeframe puts immense pressure on borrowers, especially those with unpredictable or irregular incomes. If unexpected expenses arise or income is delayed, borrowers may struggle to repay on time, leading to rollover fees and further accumulating debt.

The repayment process itself can be problematic. Many payday lenders utilize automatic withdrawals from borrowers’ bank accounts, which can lead to overdraft fees if sufficient funds are not available. These fees add to the overall cost of the loan, making it even more challenging to repay. Furthermore, some lenders engage in aggressive collection practices, adding stress and potential legal repercussions for borrowers struggling to meet their obligations.

Finally, the accessibility of payday loans can be a contributing factor to their risk. The ease with which these loans can be obtained, often requiring minimal credit checks, can lead borrowers to underestimate the potential consequences. The quick access often masks the long-term financial harm that can result from the high interest rates and fees.

Understand the True Cost of Borrowing

Payday loans are often marketed as a quick and easy solution to short-term financial emergencies. However, the true cost of borrowing through these loans significantly surpasses the initial amount borrowed. This is due to the extraordinarily high interest rates and fees associated with them.

Annual Percentage Rates (APRs) on payday loans can reach several hundred percent. This means that for every $100 borrowed, the total amount owed can quickly balloon into hundreds of dollars, depending on the loan term and repayment schedule. These high interest rates create a debt trap, making it extremely difficult to repay the loan and often leading to a cycle of repeated borrowing.

Beyond the exorbitant interest, payday lenders frequently charge a variety of additional fees. These can include origination fees, late payment fees, and rollover fees. These fees quickly add up, dramatically increasing the overall cost of borrowing and making it even harder to escape the debt cycle. Carefully examining the fine print of the loan agreement is crucial to fully understand all the associated costs.

Understanding the true cost of a payday loan involves calculating not only the interest but also all applicable fees. By understanding the full extent of the financial burden involved, you can make a more informed decision and explore alternative solutions that are more financially responsible in the long run.

Negotiate with Lenders or Credit Counselors

Being trapped in a cycle of payday loans can feel overwhelming, but negotiation is a crucial step towards breaking free. Many lenders are willing to work with borrowers facing financial hardship. Directly contacting your lender and explaining your situation is the first step. Be honest about your financial limitations and propose a realistic repayment plan. This could involve extending the loan term, reducing the payment amount, or agreeing to a different payment schedule.

Consider the potential benefits of negotiating a lower interest rate. High-interest rates are a significant driver of the payday loan cycle, making it difficult to repay the principal amount. A reduced interest rate can significantly ease the repayment burden and help you regain control of your finances. It’s important to document all agreements in writing, ensuring clarity on the revised terms and conditions.

If direct negotiation with lenders proves unsuccessful, seeking assistance from a credit counselor is a valuable alternative. Credit counselors are trained professionals who can provide guidance and support in managing debt. They can act as intermediaries between you and your lenders, negotiating on your behalf and assisting you in developing a comprehensive debt management plan. They may also help you explore options such as debt consolidation or debt settlement, potentially offering more favorable repayment terms.

Remember that seeking professional help is not a sign of weakness; it’s a strategic move towards financial recovery. A credit counselor can offer valuable insights and support, providing a structured approach to tackling your debt and preventing a relapse into the payday loan cycle. Thoroughly research and vet any credit counseling agency before engaging their services, ensuring they are reputable and non-profit, to avoid falling victim to further financial exploitation.

Seek Local Assistance Programs

Falling into a cycle of payday loans can be incredibly stressful, but you’re not alone. Many communities offer assistance programs designed to help individuals break free from this financial burden. These programs often provide a crucial safety net, offering temporary financial relief and guidance to navigate long-term financial stability.

Local charities and non-profit organizations frequently offer financial assistance, including emergency funds and budget counseling. These resources can provide immediate help with covering essential expenses, reducing the need to resort to high-interest payday loans. They may also offer assistance with creating a realistic budget and exploring options for debt management.

Your local government may also have programs designed to address financial hardship. These could include programs specifically targeting low-income families, unemployment benefits, or assistance with utility bills. Contacting your city or county’s social services department is a great starting point to explore these options. They can often provide comprehensive information on available resources and direct you to the appropriate programs.

Faith-based organizations often play a vital role in providing financial assistance within their communities. Many churches, synagogues, and mosques have established programs to help individuals facing financial difficulties. These programs may include direct financial aid, food banks, or referrals to other support services.

Remember, seeking help is a sign of strength, not weakness. These local assistance programs are designed to empower individuals to overcome financial challenges and rebuild their financial futures. Don’t hesitate to explore these options as a crucial step in breaking free from the cycle of payday loans.

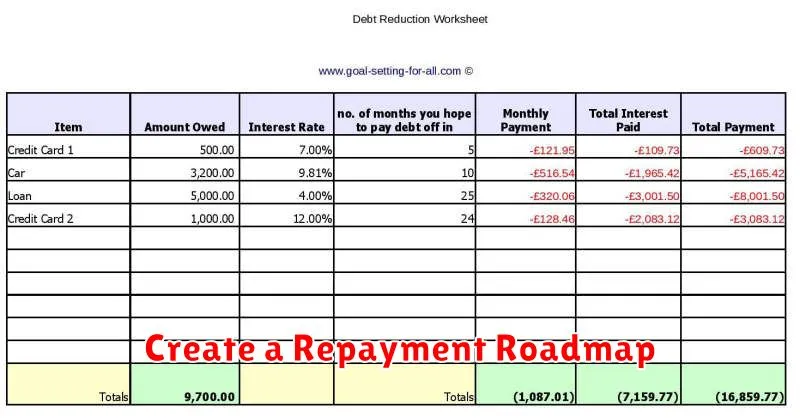

Create a Repayment Roadmap

Escaping a payday loan cycle requires a structured plan. Creating a detailed repayment roadmap is crucial for success. This roadmap should be personalized to your specific financial situation and should outline a clear path towards eliminating your debt.

First, list all your payday loans. Include the lender, the outstanding balance, the interest rate, and the due date for each loan. This comprehensive list provides a clear picture of your total debt burden. Be meticulous; accuracy is key to effective debt management.

Next, prioritize your loans. Consider factors such as interest rates, due dates, and loan amounts when deciding which loans to tackle first. Focus on paying off the loans with the highest interest rates first to minimize the overall interest paid. This avoids paying exorbitant fees and keeps more of your money for principal repayment.

Develop a realistic budget. This involves tracking your income and expenses to identify areas where you can cut back. Identify non-essential expenses that you can reduce or eliminate to free up funds for loan repayment. This disciplined approach is essential for long-term financial stability.

Explore additional income streams. Consider taking on a part-time job, selling unused possessions, or freelancing to generate extra cash flow for debt repayment. Every extra dollar contributes to faster debt reduction, bringing you closer to financial freedom.

Finally, stick to your plan. Repayment is a marathon, not a sprint. Consistent effort is required to break the cycle. Regularly review and adjust your plan as needed, but maintain your commitment to paying off your debt.

Build a Backup Fund to Avoid Repeating

Falling into a payday loan cycle is a difficult situation, often characterized by recurring borrowing to cover previous loans. Breaking free requires a fundamental shift in financial management, and a crucial element of this is building a backup fund.

This fund acts as a safety net, providing a buffer against unexpected expenses. Instead of resorting to high-interest payday loans when an emergency arises (car repair, medical bill, etc.), you can draw from your backup fund. This prevents the cycle from restarting.

Starting small is key. Begin by setting aside even a small amount each month – perhaps $20 or $50. Consistency is more important than the initial amount. As your savings grow, gradually increase the contribution until you reach a comfortable emergency fund level. A general guideline is to aim for three to six months’ worth of essential living expenses.

To effectively build this fund, meticulous budgeting is necessary. Track your income and expenses to identify areas where you can cut back. Consider reducing non-essential spending, such as eating out or entertainment, to free up funds for your emergency savings. Automating your savings, setting up automatic transfers from your checking account to your savings account, can also significantly contribute to your progress.

Building a backup fund isn’t a quick fix, but it’s a vital long-term strategy. It empowers you to handle unexpected costs without relying on the predatory nature of payday loans, ultimately breaking the cycle and fostering financial stability.