Saving for a house down payment can feel like a daunting task, but with the right strategy and commitment, it’s entirely achievable. This comprehensive guide will equip you with the knowledge and tools needed to successfully navigate the process of saving for your dream home. We’ll explore effective saving techniques, budgeting strategies, and smart financial planning tips to accelerate your progress toward achieving your homeownership goals. Learn how to overcome common obstacles and build a robust down payment fund, setting you on the path to financial security and homeownership.

This article provides a step-by-step approach to building a substantial down payment, covering everything from assessing your current financial situation and setting realistic savings goals to exploring different saving vehicles and minimizing unnecessary expenses. Whether you’re a first-time homebuyer or looking to upgrade, mastering the art of saving for a down payment is crucial for securing a mortgage and realizing your dream of owning a home. We’ll cover various mortgage options and discuss how your down payment amount impacts your overall home buying costs.

Set a Specific Savings Target

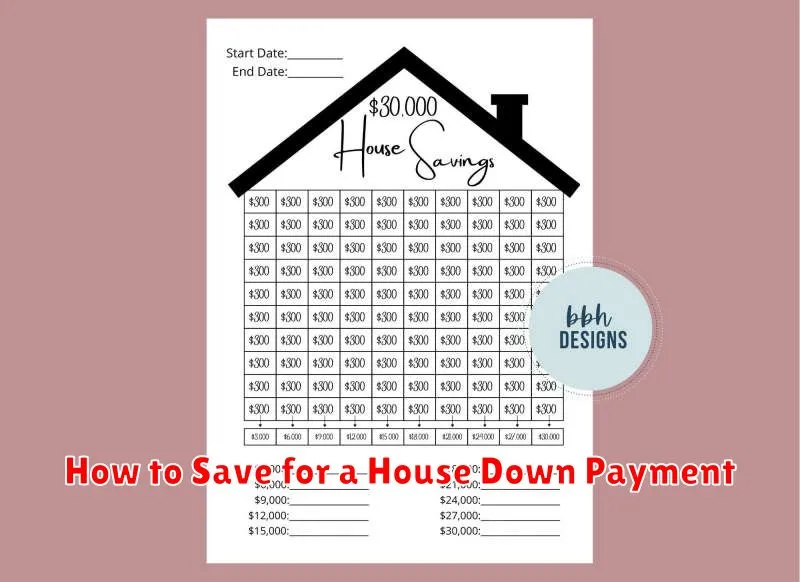

Saving for a down payment requires a clear financial goal. Instead of vaguely aiming to “save for a house,” establish a specific target savings amount. This will provide a concrete objective to work towards and help you track your progress more effectively.

To determine your target, you’ll need to research average house prices in your desired area and factor in the required down payment percentage. Many lenders require a minimum down payment of 20%, but options exist for smaller down payments, though they may come with higher interest rates or additional fees. Researching mortgage options early will give you a clearer idea of your necessary savings.

Consider all associated costs beyond the down payment, such as closing costs, moving expenses, and potential repairs or renovations. Incorporating these extra expenses into your target savings will prevent unexpected financial burdens later. A thorough budget detailing all anticipated costs will be extremely beneficial in this process.

Once you have a total savings target, break it down into smaller, more manageable monthly or weekly savings goals. This will make the overall goal seem less daunting and will help you stay motivated throughout your savings journey. Regularly review your progress and adjust your savings plan as needed, accounting for any unexpected changes in your income or expenses.

Open a High-Yield Savings Account

Saving for a significant purchase like a house requires a dedicated strategy, and a crucial component is choosing the right savings vehicle. A high-yield savings account offers a superior alternative to standard savings accounts because it provides a considerably higher interest rate.

This increased interest rate allows your savings to grow faster, significantly accelerating your progress towards your down payment goal. While the interest earned might seem small initially, the compounding effect over time can make a substantial difference. Look for accounts offered by reputable online banks or credit unions, as they often offer the most competitive rates.

Before opening an account, carefully compare Annual Percentage Yields (APYs) from different institutions. Pay close attention to any associated fees or minimum balance requirements. Choosing an account with a high APY and minimal fees will maximize your savings growth and minimize costs.

Consider the accessibility of your chosen account. While a high yield is important, you’ll need convenient access to your funds should unexpected expenses arise or if you need to make a down payment sooner than anticipated. Many high-yield accounts offer online and mobile banking features, providing easy access to your money.

By selecting a high-yield savings account and diligently contributing to it regularly, you’ll significantly improve your chances of accumulating the necessary funds for your down payment within a reasonable timeframe. Remember to factor in other savings and investment strategies in your overall financial plan.

Cut Back on Discretionary Spending

Saving for a significant down payment requires a committed approach to managing your finances. One of the most effective strategies is to carefully examine and reduce your discretionary spending. This refers to expenses that are not essential for your basic needs, such as housing, food, and transportation.

Start by tracking your spending for a month. Use budgeting apps or spreadsheets to identify where your money is going. You might be surprised by how much you spend on non-essential items like eating out, entertainment, or subscriptions. Once you have a clear picture of your spending habits, you can begin to make informed decisions about where to cut back.

Consider reducing or eliminating expenses that are not providing significant value. For example, can you reduce the number of times you eat out each week? Could you cancel unused streaming services or gym memberships? Small reductions in numerous areas can add up to substantial savings over time.

Another effective tactic is to find affordable alternatives. Instead of frequenting expensive restaurants, explore cooking more meals at home. Instead of attending expensive concerts, consider free community events. By finding cheaper alternatives, you can maintain your lifestyle while still saving money towards your down payment.

Remember that saving for a down payment is a long-term goal. While making immediate sacrifices might seem difficult, the reward of owning a home will be well worth the effort. By consistently reducing discretionary spending, you’ll accelerate your progress toward reaching your financial goal.

Automate Monthly Transfers

One of the most effective strategies for saving for a house down payment is to automate your savings. This removes the burden of manually transferring funds each month, ensuring consistency and minimizing the risk of forgetting.

Most banks and online financial institutions offer the ability to set up recurring transfers. You can schedule a specific amount to be automatically transferred from your checking account to your savings account on a chosen day each month. This could be on payday, or any other day that works best for your budget.

Consider setting up a separate high-yield savings account specifically for your down payment. This will help you visualize your progress and potentially earn more interest on your savings. Make sure to choose an account with minimal or no fees.

Start small. Even transferring a small amount each month will add up over time. As your income increases or your expenses decrease, you can gradually increase the amount of your automated transfer.

Consistency is key. While it may be tempting to skip a transfer occasionally, maintaining a regular transfer schedule will significantly accelerate your progress toward your down payment goal. The automated nature of the transfers makes it far easier to maintain this consistency.

Review your automated transfers periodically to ensure they still align with your financial goals and current income. Adjust the transfer amount as needed to maintain an appropriate balance between saving and spending.

Track Your Progress Visually

Saving for a significant down payment requires discipline and consistent effort. A crucial element often overlooked is visualizing your progress. Seeing your savings grow can be incredibly motivating and help you stay on track.

One effective method is to use a savings tracker. This could be a simple spreadsheet, a dedicated savings app, or even a physical chart where you visually represent your progress towards your goal. Many apps offer interactive charts and graphs, providing a clear picture of your accumulating funds.

Consider creating a visual representation of your goal. For example, if saving for a $20,000 down payment, you could draw a bar graph, gradually filling it in as you save. Alternatively, you could use a jar or container to represent your savings goal, physically adding money and watching it fill up.

The key is to find a method that works best for you and keeps you engaged. Regularly reviewing your visual progress tracker will reinforce your commitment and provide a sense of accomplishment as you near your target.

Remember to adjust your tracker as needed. If your savings pace changes, update your visual representation to reflect the reality of your situation. This flexibility ensures your tracker remains a helpful and accurate tool for your journey.

Avoid Using the Fund Prematurely

One of the biggest challenges in saving for a house down payment is the temptation to use the money for other things. Unexpected expenses, tempting purchases, or even seemingly small indulgences can quickly erode your savings.

To avoid this, establish a clear financial plan and stick to it. This plan should detail your savings goals, including the target amount for your down payment and your anticipated timeline. Regularly review your progress and make necessary adjustments, but resist the urge to divert funds unless absolutely necessary.

Consider automating your savings. Setting up automatic transfers from your checking account to your savings account ensures a consistent contribution, even when you’re tempted to spend elsewhere. This removes the decision-making process and makes saving a regular, non-negotiable part of your budget.

It’s also crucial to maintain a realistic budget that accounts for both your necessary expenses and any discretionary spending. By carefully tracking your income and expenses, you can identify areas where you might be overspending and redirect those funds towards your down payment savings. This disciplined approach ensures that your savings remain dedicated to your long-term goal of homeownership.

Remember, the patience and discipline you show now will significantly impact your ability to achieve your goal of buying a home. While the temptation to use the funds prematurely might be strong, the long-term benefits of maintaining a dedicated savings account far outweigh any short-term gratification.