Are you constantly struggling to make ends meet? Do you find yourself constantly wanting more, even when you have enough? Learning to effectively separate your needs from your wants is a crucial skill for achieving financial freedom and reducing stress. This comprehensive guide will equip you with practical strategies and techniques to differentiate between essential necessities and non-essential desires, empowering you to make informed financial decisions and prioritize your spending effectively. Mastering this skill will dramatically improve your budgeting, saving, and overall financial well-being.

This article will delve into the core concepts of needs versus wants, providing clear examples to help you understand the distinction. We will explore effective methods for identifying and categorizing your spending habits, enabling you to gain a comprehensive understanding of where your money is going. Ultimately, you’ll learn how to create a budget that aligns with your financial goals, allowing you to satisfy your needs while responsibly managing your wants. By the end, you will have a practical framework for making conscious purchasing decisions that contribute to a more secure and fulfilling financial future.

Why It’s Crucial for Budgeting

Effective budgeting is essential for successfully separating needs from wants. Without a clear budget, it’s incredibly difficult to track your spending and identify areas where you might be overspending on non-essential items.

A budget provides a visual representation of your income and expenses. This allows you to see exactly where your money is going, highlighting the difference between necessary expenditures (like rent, groceries, and utilities) and discretionary spending (like entertainment, dining out, and luxury items). This clarity is paramount in making informed decisions about your spending habits.

By allocating specific amounts to different categories within your budget, you can consciously decide where to prioritize your funds. This process forces you to confront your spending habits and make conscious choices between satisfying your needs and fulfilling your wants. You’ll be better equipped to say no to impulse purchases and make more strategic financial decisions.

Furthermore, a well-structured budget promotes financial stability and helps you avoid accumulating debt. When you understand where your money goes, you’re less likely to overspend and fall into financial hardship. This clarity directly impacts your ability to save for long-term goals and achieve your financial aspirations.

In conclusion, a budget is a powerful tool for distinguishing needs from wants and ensuring you’re making responsible financial choices. It provides the foundation for sound financial management and helps you achieve your financial objectives.

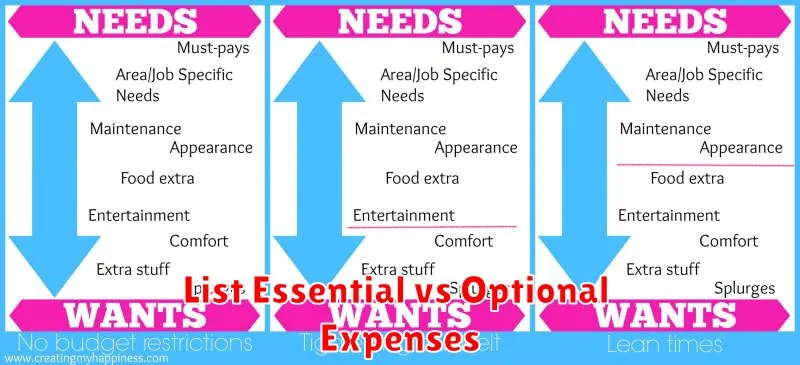

List Essential vs Optional Expenses

Differentiating between essential and optional expenses is crucial for effective budgeting and financial well-being. Understanding this distinction allows for informed spending decisions and helps prioritize needs over wants.

Essential expenses are those necessary for survival and maintaining a basic standard of living. These typically include housing (rent or mortgage payments), utilities (electricity, water, gas, internet), food, transportation (car payments, gas, public transport), healthcare (insurance premiums, medical bills), and debt repayments (minimum payments on loans). The specific items considered essential may vary based on individual circumstances and location.

Optional expenses, on the other hand, are not strictly necessary for survival. These are often discretionary purchases that enhance comfort, entertainment, or lifestyle. Examples of optional expenses include eating out, subscriptions (streaming services, gym memberships), entertainment (movies, concerts), clothing (beyond essential needs), hobbies, and luxury goods. While these expenses can add value to life, they should be carefully managed to avoid overspending and financial strain.

Creating a detailed list of your own essential and optional expenses is a vital first step in gaining control of your finances. This allows you to visualize your spending habits and identify areas where you can potentially reduce spending on optional items to free up funds for savings or debt reduction.

By consciously distinguishing between needs and wants and carefully tracking your spending, you can develop a sustainable budget that supports both your current needs and your long-term financial goals. A clear understanding of this difference is key to building a financially secure future.

The 30-Day Rule for Buying

One of the most effective strategies for discerning between needs and wants is the 30-day rule. This simple yet powerful technique involves delaying any non-essential purchase for a full 30 days. Instead of impulsively buying something, you wait.

During this 30-day waiting period, you objectively consider the purchase. Do you still truly want the item after the initial excitement has faded? Is it a genuine need, or just a fleeting desire fueled by advertising or social pressure? This period allows for a more rational assessment, unburdened by the immediate emotional urge to buy.

The benefits of the 30-day rule are numerous. It curtails impulsive spending, leading to significant savings over time. By delaying gratification, you gain clarity and avoid regrettable purchases. It promotes mindful consumption, encouraging you to think critically about your spending habits and ultimately make better financial decisions.

Implementing the 30-day rule is straightforward. Simply identify any item you’re considering purchasing. If it’s not an urgent necessity (like groceries or medicine), write it down and wait. After 30 days, re-evaluate your desire. If the want persists, and it aligns with your budget and financial goals, you may proceed with the purchase. If not, you’ve successfully avoided an unnecessary expense.

The 30-day rule isn’t about deprivation; it’s about conscious consumption. It’s a tool to help you distinguish between genuine needs and fleeting wants, empowering you to make informed financial choices and achieve your financial goals more effectively.

Using Visual Cues to Stay Focused

One effective strategy for distinguishing between needs and wants involves leveraging visual cues. By carefully organizing your environment and utilizing visual reminders, you can significantly improve your ability to prioritize and resist impulsive purchases.

A simple technique is to create a visual representation of your financial goals. This could be a physical board with images and descriptions of your desired outcomes, or a digital document with charts tracking progress. Seeing these goals regularly serves as a powerful reminder of your long-term needs and helps you to resist short-term wants that could derail your progress.

Another helpful approach involves creating physical spaces dedicated to specific purposes. For example, designating a specific area for items related to your needs and another for items that represent your wants can promote clearer mental separation. This separation can make it easier to assess whether a purchase aligns with your long-term objectives.

Furthermore, consider using color-coding to further distinguish needs from wants. For instance, you might associate needs with a calming color like blue or green, representing stability and security. Meanwhile, wants could be represented by a more stimulating color like red or orange, visually communicating their less essential nature. This simple system can help you quickly categorize items and make more informed purchasing decisions.

Ultimately, using visual cues is about creating a supportive environment that encourages mindful consumption. By carefully crafting your visual surroundings, you can enhance your ability to stay focused on your needs and resist the allure of unnecessary wants.

Teach the Principle to the Family

Teaching your family to differentiate between needs and wants is a crucial step in establishing sound financial habits. This isn’t a one-time conversation, but rather an ongoing process of education and modeling.

Start by having open and honest discussions about your family’s financial situation. Explain that while we all have desires, it’s important to prioritize our essential needs first. This will help everyone understand the limitations and the importance of responsible spending.

Involve your children in the decision-making process. When considering purchases, discuss whether an item is a need (like food or clothing) or a want (like a video game or a new toy). Explain the difference using clear and simple examples. For instance, food is a need because it sustains life, whereas a new toy is a want that provides entertainment but isn’t essential.

Consider using a visual aid, such as a chart or graph, to illustrate the concept. This can make the lesson more engaging and easier for younger children to understand. You could even create a family budget together, allowing them to see firsthand where the money is allocated and how choices impact spending.

Encourage your children to save for their wants. This teaches patience, delayed gratification, and the value of hard work. It also empowers them to make informed choices about their spending. A piggy bank or savings account can be a great tool for this.

Remember, consistency is key. Regularly reinforce the principles of distinguishing needs from wants through everyday examples and conversations. By consistently modeling responsible financial behavior, you are setting your family on a path towards financial literacy and security.

Track Emotional Spending Patterns

Understanding your spending habits is crucial to distinguishing between needs and wants. A key aspect of this understanding involves recognizing and tracking your emotional spending patterns. Many purchases are driven not by logic or necessity, but by underlying emotions.

Take some time to reflect on your recent purchases. Consider the emotions you were experiencing at the time of purchase. Were you feeling stressed, bored, sad, lonely, or even exceptionally happy? Identifying these emotional triggers can help you pinpoint situations that lead to impulse buying and unnecessary expenses. Keeping a detailed spending journal, noting both the purchase and the associated emotion, can prove incredibly insightful.

For example, you might discover a pattern of emotional eating leading to increased grocery spending, or a tendency to online shop during periods of loneliness or stress. Once these patterns are identified, you can develop strategies to cope with these emotions in healthier, more financially responsible ways. This might involve engaging in alternative activities, like exercise, meditation, or spending time with loved ones, instead of resorting to retail therapy.

Recognizing your emotional spending triggers is a powerful first step toward making more conscious purchasing decisions. By understanding the underlying emotions driving your spending, you can gradually shift from reactive, emotional spending towards more intentional, needs-based purchases.

This mindful approach will not only improve your financial health but also foster a greater sense of control over your spending and your overall well-being. Tracking your spending and connecting it to your emotional state is a crucial element in learning to differentiate needs from wants.