Are you looking for a simple yet effective way to boost your savings without drastically altering your lifestyle? Then discover the power of Zero-Dollar Days! This proven saving tactic focuses on strategically eliminating discretionary spending for a single day each week, allowing you to effortlessly accumulate significant savings over time. Learn how this budget-friendly strategy can help you achieve your financial goals and build a stronger financial future.

Implementing Zero-Dollar Days is surprisingly easy and adaptable to any budget. This flexible approach to saving doesn’t require complex spreadsheets or restrictive budgeting apps. Instead, it emphasizes mindful spending and conscious choices, empowering you to take control of your finances. Uncover the secrets to successfully implementing Zero-Dollar Days and watch your savings grow with this practical and effective method. Prepare to be amazed by how much you can save with this simple yet powerful technique.

What Is a Zero-Dollar Day?

A zero-dollar day is a day where you intentionally spend absolutely nothing on non-essential items. This doesn’t mean you can’t pay bills or cover necessary expenses like groceries or gas; rather, it focuses on eliminating all discretionary spending for a single day.

The goal is to consciously reduce spending and build awareness of your daily financial habits. By actively choosing not to spend on anything beyond necessities, you gain a clearer picture of where your money goes and identify potential areas for future savings. It’s a powerful tool for budgeting and saving money.

Zero-dollar days are not about deprivation; they’re about mindful spending. Consider it a financial reset, a chance to break ingrained spending patterns and appreciate the value of what you already have. It’s a surprisingly effective method to curb impulsive purchases and cultivate a more conscious relationship with your finances.

While it may seem challenging at first, incorporating even a few zero-dollar days into your monthly routine can significantly impact your savings over time. The cumulative effect of these small, intentional changes can lead to substantial long-term financial gains.

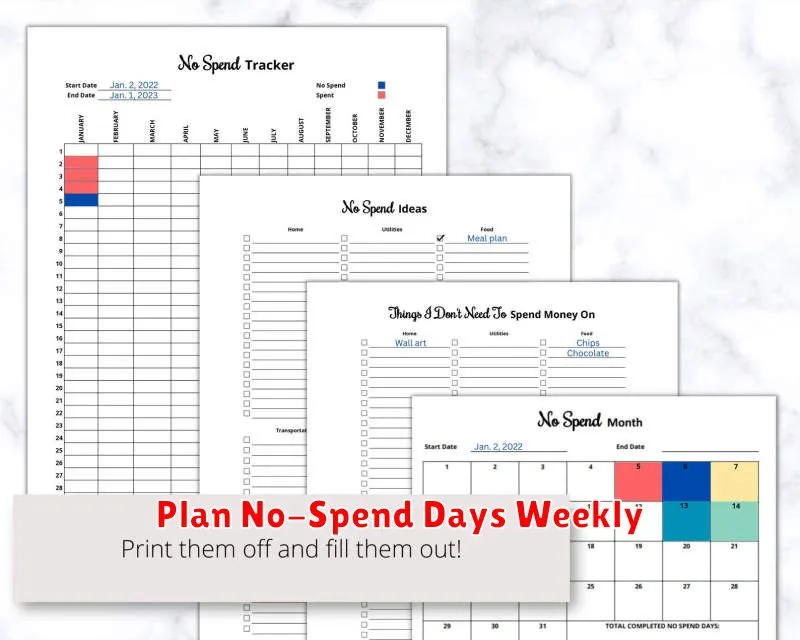

Plan No-Spend Days Weekly

Implementing no-spend days is a powerful strategy within a zero-dollar budget. The concept is simple: for a predetermined number of days each week, you commit to spending absolutely nothing beyond essential bills and pre-planned expenses.

The effectiveness of this method lies in its consistent application. Rather than attempting a drastic, complete spending freeze, which can be difficult to maintain, incorporating regular no-spend days offers a more manageable and sustainable approach. This gradual change in spending habits fosters a mindful awareness of unnecessary purchases.

Consider starting with one or two no-spend days a week. This allows you to build the habit without feeling overwhelmed. Choose days that work best with your schedule and lifestyle. For example, you might opt for weekdays to avoid the temptation of weekend shopping or social outings.

To maximize the impact of your no-spend days, plan ahead. Prepare meals in advance, pack your lunch, and avoid situations that might lead to unplanned spending. Engaging in free activities, such as reading, spending time with loved ones, or pursuing hobbies, can help you stay focused and avoid the urge to spend money.

Tracking your progress is crucial. Keeping a simple journal or using a budgeting app can help you monitor your spending habits and identify areas where you might be able to reduce expenses further. The data you gather will provide valuable insights into your spending patterns, ultimately making your no-spend days even more effective.

Remember, the goal is not to deprive yourself but to cultivate a more intentional relationship with money. By consciously choosing to forgo unnecessary spending on specific days, you’ll develop a greater appreciation for your resources and build healthier financial habits.

Avoid Temptation and Triggers

A crucial element of successful zero-dollar days is minimizing exposure to temptation and triggers that might lead to unnecessary spending. This involves a proactive approach to managing your environment and your impulses.

Consider unsubscribing from email newsletters or deleting shopping apps that constantly bombard you with deals and promotions. These digital distractions can easily derail your savings goals, especially when you’re feeling vulnerable to impulsive purchases.

Furthermore, be mindful of your physical surroundings. If you frequently find yourself making unplanned purchases at a particular store, try to avoid that location during your zero-dollar day. Alternatively, plan your shopping trips carefully, sticking to a pre-made list to avoid straying from essentials.

Recognizing your personal spending triggers is key. Are you more likely to spend when you’re stressed, bored, or socializing with friends? Develop strategies to cope with these situations without resorting to retail therapy. This could involve engaging in alternative activities like exercise, meditation, or spending time with loved ones in non-consumption-based settings.

Planning ahead is also essential. Preparing your meals for the day, packing your lunch, and making a conscious decision about your activities can significantly reduce the chance of unexpected spending. By proactively managing your environment and your impulses, you can dramatically increase your chances of success with your zero-dollar days.

Use It to Break Bad Habits

Zero-dollar days aren’t just about saving money; they’re a powerful tool for breaking bad spending habits. By consciously choosing to spend nothing on a particular day, you create a space for mindful reflection on your spending patterns.

Many people find that they unconsciously reach for their wallets out of habit, rather than genuine need. A zero-dollar day forces a pause, prompting you to question whether a purchase is truly necessary or simply a result of ingrained behavior. This self-awareness is crucial in curbing impulsive spending and breaking free from the cycle of unnecessary purchases.

The discipline required to successfully complete a zero-dollar day can be applied to other areas of life. The same self-control you exercise in resisting spending temptations can be transferred to tackling other bad habits, whether it’s excessive snacking, procrastination, or even excessive screen time. The success you experience with zero-dollar days can foster a sense of empowerment and build self-confidence, making it easier to address other areas for improvement.

Furthermore, the money saved on zero-dollar days can be directly applied towards achieving your financial goals, reinforcing the positive association between self-discipline and tangible rewards. This creates a virtuous cycle: the success of one zero-dollar day motivates you to plan for more, which leads to greater savings, and consequently, greater financial security.

Combine With Weekly Budget Planning

Integrating zero-dollar days into a weekly budget plan significantly enhances its effectiveness. A well-structured weekly budget already provides a framework for tracking income and expenses, allowing for mindful spending decisions. By incorporating designated zero-dollar days, you actively reinforce this mindful approach and cultivate a habit of conscious consumption.

The combination offers several key advantages. Firstly, it allows for better visualization of your spending patterns. When you actively track expenses against your planned budget, and then factor in zero-dollar days where spending is intentionally minimized, you gain a clearer understanding of where your money goes. This enhanced visibility allows for more effective budget adjustments in subsequent weeks.

Secondly, the synergy strengthens financial discipline. Weekly budgeting, even without zero-dollar days, promotes disciplined spending. Adding zero-dollar days intensifies this discipline, making it a routine and an ingrained habit rather than an occasional act of will. This structured approach consistently reinforces your commitment to saving.

Thirdly, this combined approach facilitates achieving savings goals faster. Zero-dollar days provide a quick and substantial boost to your savings, while weekly budgeting ensures consistent progress even on days with expenses. The combination creates a powerful, synergistic effect that maximizes your savings potential.

Finally, combining these strategies fosters a more sustainable approach to saving. By incorporating zero-dollar days into a pre-existing framework like a weekly budget, you are creating a long-term, repeatable system, rather than a series of isolated saving efforts. This sustained effort builds a stronger foundation for financial security over the long term.

Celebrate Completion Without Spending

Achieving a goal, whether it’s finishing a project, completing a course, or reaching a fitness milestone, deserves celebration. However, celebratory spending can quickly derail your savings goals. Fortunately, there are numerous ways to mark your accomplishments without spending a single dollar.

One fulfilling option is to indulge in a self-care activity. This could involve a relaxing bath, a long walk in nature, reading a good book, or listening to your favorite music. These activities provide a sense of accomplishment and well-being without the need for financial outlay.

Consider organizing a free social gathering. Invite friends or family over for a potluck dinner, a board game night, or an outdoor picnic. The focus is on connection and shared experiences, not expensive entertainment.

Another fulfilling approach is to give back to your community. Volunteering your time at a local charity or helping a neighbor is a rewarding way to celebrate your achievements and make a positive impact. This act of service provides a sense of purpose and satisfaction that far outweighs the value of any material purchase.

Finally, taking the time for reflection and planning is crucial. Pause to appreciate your accomplishments and reflect on the journey. Use this opportunity to strategize your next steps and set new, ambitious goals. This planning session, a celebration of past success and a commitment to future growth, is priceless.